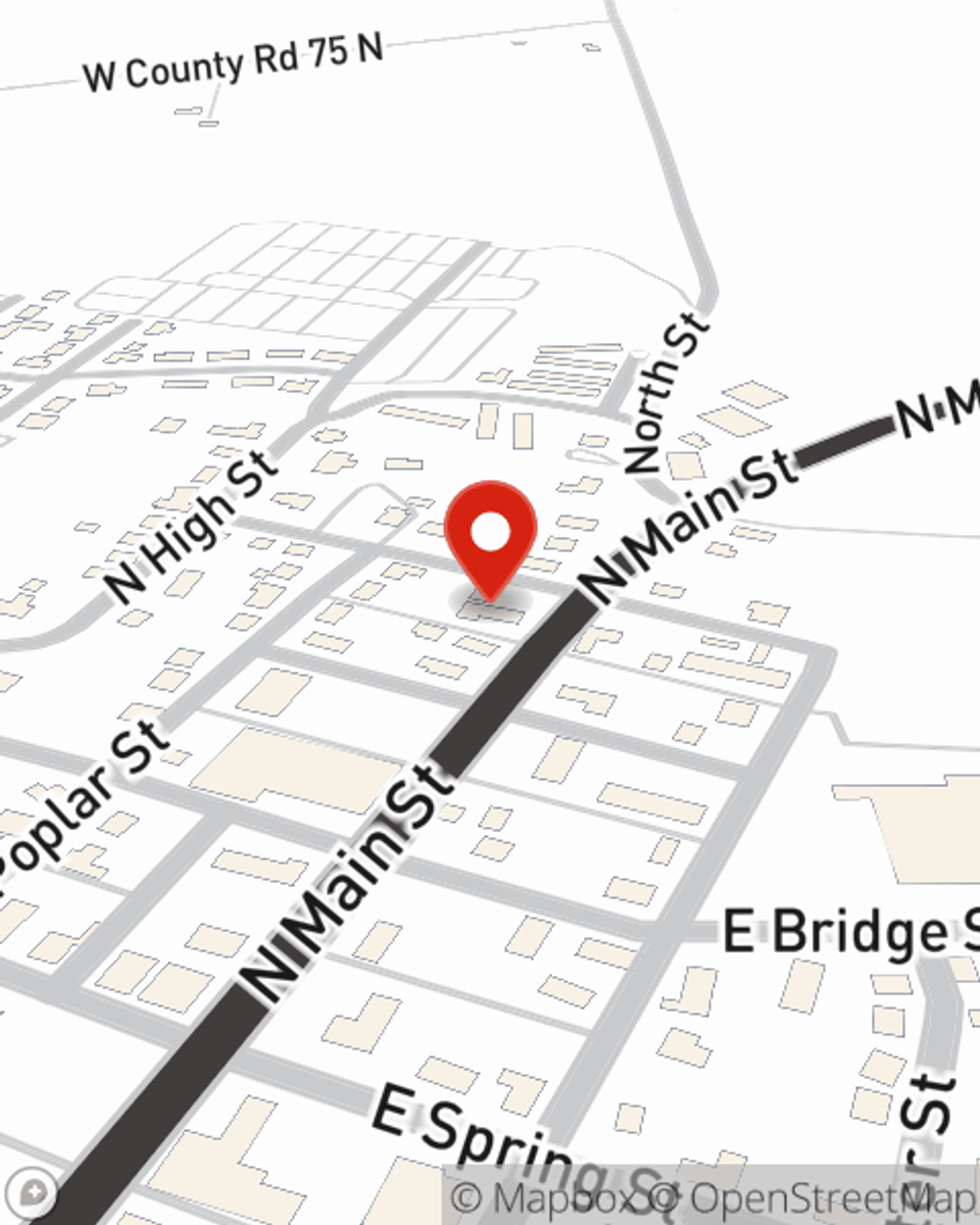

Business Insurance in and around Brownstown

One of Brownstown’s top choices for small business insurance.

Almost 100 years of helping small businesses

- Brownstown

- Seymour

- Jackson County

- Medora

- Vallonia

- Clearsprings

- Crothersville

- Reddington

- Jonesville

Your Search For Outstanding Small Business Insurance Ends Now.

Operating your small business takes creativity, hard work, and outstanding insurance. That's why State Farm offers coverage options like extra liability coverage, a surety or fidelity bond, worker's compensation for your employees, and more!

One of Brownstown’s top choices for small business insurance.

Almost 100 years of helping small businesses

Get Down To Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Kayla Stice for a policy that protects your business. Your coverage can include everything from extra liability coverage or worker's compensation for your employees to commercial auto insurance or group life insurance if there are 5 or more employees.

Call or email agent Kayla Stice to explore your small business coverage options today.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Kayla Stice

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.